Sustainability Activities (ESG)

Risk Management

Risk Management Approach and Policies

Risk Management

Risk Management Approach and Policies

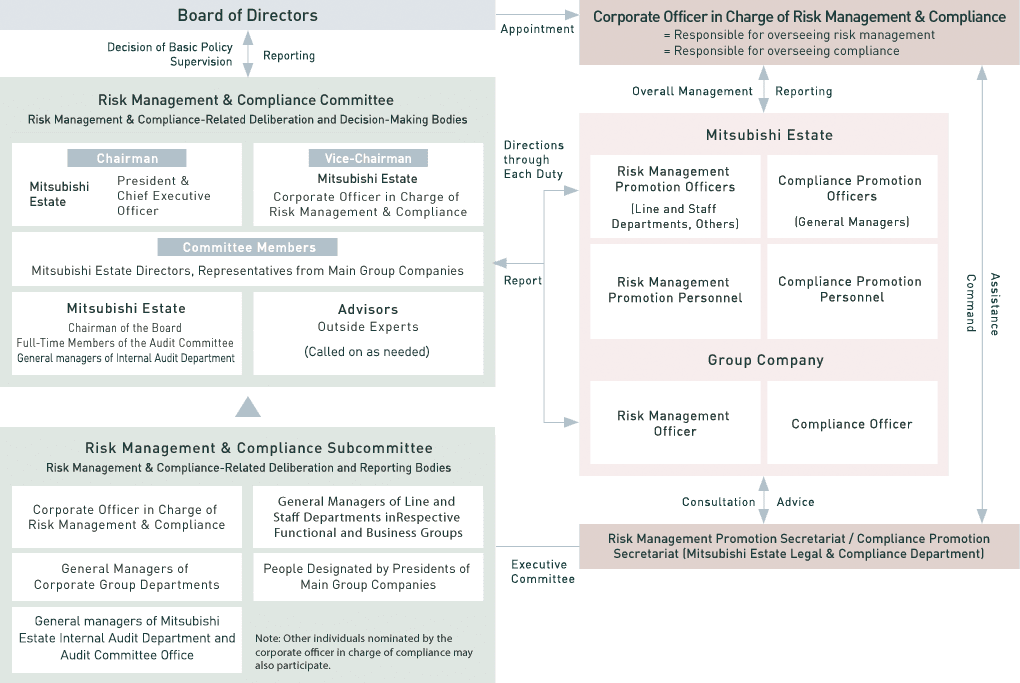

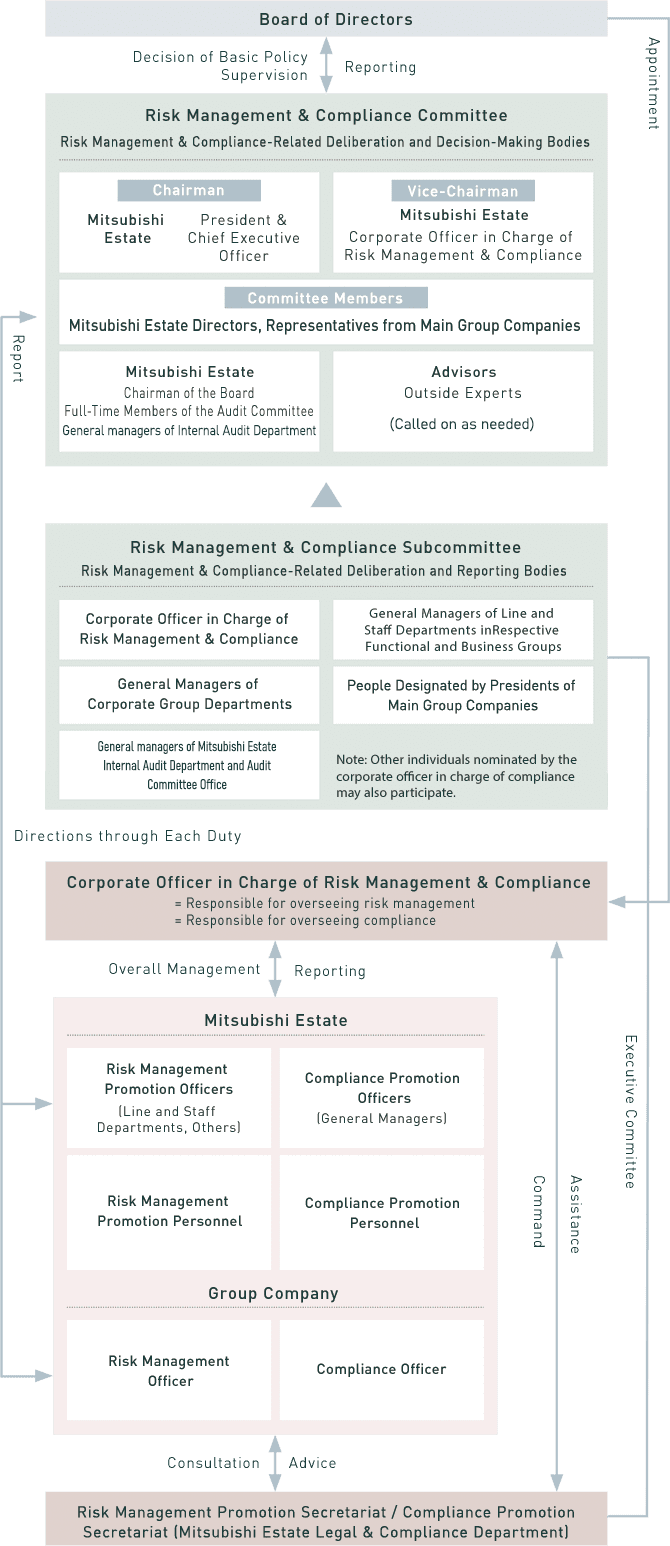

The Mitsubishi Estate Group has established the Mitsubishi Estate Group Risk Management Rules and has set up a risk management system to manage risks in all of its business activities. Mitsubishi Estate has also established the Risk Management & Compliance Committee to oversee the Group’s risk management and formed the Risk Management & Compliance Subcommittee as a working-level consulting body responsible for such matters as the collection of risk management-related information. The corporate officer in charge of risk management and compliance is appointed by resolution of the Board of Directors to take responsibility for overseeing risk management, and general managers of business groups and general managers from Group departments have been designated as risk management officers. We promote risk management activities through the Mitsubishi Estate Legal & Compliance Department, which serves as the secretariat. We have also established and implemented action guidelines, contact and initial response systems, and business continuity plans for use in times of crisis.

Risk Management and Compliance System (As of April 2025)

Risk Management Activities

Risk Management Activities of Respective Individual Business and Functional Groups and Group Companies

Individual Group companies and functional and business groups identify important risks based on a risk analysis and carry out activities throughout the year to reduce the risks identified. In addition, the general managers of each functional or business group ascertain the status of risk management activities of different business companies under the jurisdiction of each group and provide coordination and support.

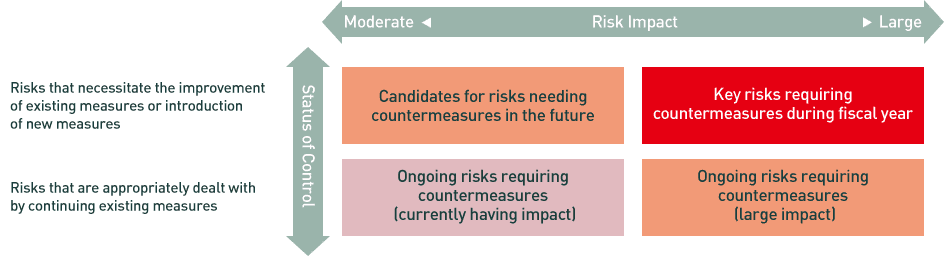

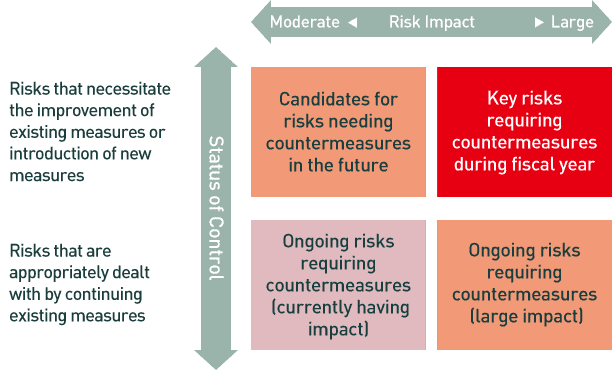

Identification and Monitoring of Key Risks That Need Particular Attention from the Group

To accurately grasp the risks facing the Group as a whole, and by selecting and mapping key risks that require measures to be taken, the risks that must be addressed and their level of priority are brought to light. While monitoring risks throughout the year, particularly key risks, support is provided as necessary.

Risk Map

Risk Management Related to Investment Projects

Risk Management Related to Investment Projects

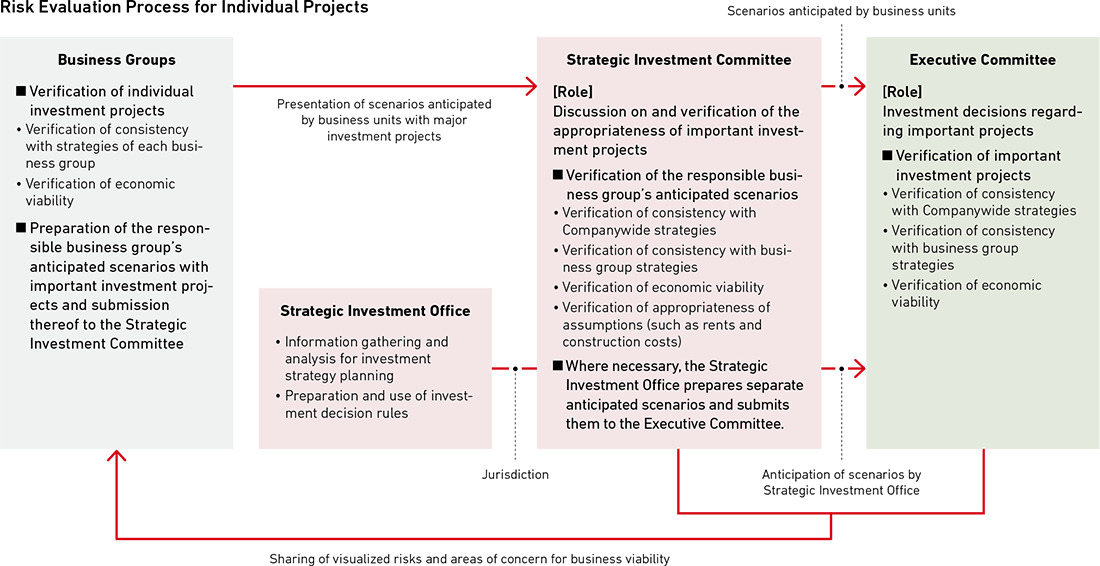

Among the various risks recognized by the Mitsubishi Estate Group, risks related to investment projects are based on the assessment of business viability by company-wide research functions and under investment decision rules of the Strategic Investment Office. Prior to the deliberation of important investment projects by the Executive Committee, which is chaired by the president & CEO of Mitsubishi Estate and is responsible for strategic planning for the entire Group and monitors the progress of each business toward realizing this strategy, the Strategic Investment Committee deliberates and evaluates profitability, the nature of risks and related countermeasures, and other matters. At each phase, risk assessments are also conducted from legal and financial aspects in order to grasp an overall picture of the risks.

Strategic Investment Committee

In its deliberations, in addition to assessing the economic viability of a given project using multiple indicators, the Strategic Investment Committee verifies the appropriateness of various aspect of premises, such as rents, unit selling prices, and construction costs. For risks, in particular, simulations of upside and downside scenarios are incorporated into investment decision rules. The difference between the scenario set by the responsible business group in charge of the project and the downside scenario is recognized as risk. The Strategic Investment Committee holds discussions on the acceptable limits of that risk.

Risk Management Initiatives > Holding Risk Management and Compliance Lectures

Risk Management Initiatives

Holding Risk Management and Compliance Lectures

Mitsubishi Estate holds risk management and compliance lectures for managers and executives, including those at Group companies. The lecture topic is chosen from genres related to risk management and compliance, in light of social conditions in that particular year.

Dealing with Major Risks

Below are some examples of risks that have come to light in the Mitsubishi Estate Group through risk management activities and various business activities and countermeasures that have been taken.

| Risks | Countermeasures | |

|---|---|---|

| Risks of Natural and Man-Made Disasters, etc. | Amid growing social interest in the way companies respond in the event of pandemics and natural disasters, such as typhoons, in the unlikely event of shortcomings in a response deemed appropriate by the Group, safety management, reputational, and other risks could emerge, which might affect the Group’s business promotion and performance. | At facilities that it owns or operates, the Mitsubishi Estate Group prepares business continuity plans for use in the event of a natural or man-made disaster. In addition, redevelopment projects promoted by the Group put in place advanced disaster-management functions and adopt disaster countermeasures through area management. |

| Risks of a Deterioration in Real Estate Market Conditions | The Group’s performance may be adversely affected if real estate market conditions were to deteriorate in accordance with an economic downturn caused by domestic and overseas factors. In such circumstances, the Group would need to pay particular attention to the progress of occupancy rates in the Tokyo office leasing market and to multi-use development, redevelopment, and other plans, as these entail large-scale investments over long-term development time frames. | The basic policy of the Group is to conclude relatively longterm lease contracts with customers in its office building leasing business. The resultant prospect of stable lease revenues mitigates to a certain degree the risk of sharp economic fluctuations. |

| Risks of Substantial Rises in Material Prices | If material prices rose in conjunction with a steep increase in raw material and crude oil prices due to domestic and overseas factors, the Group may not necessarily be able to offset this through increased sales prices and rental fees in its real estate development business, which may have an adverse effect on performance. | The Group implements cost control measures, such as the early placement of construction material orders, and will monitor trends in material prices in a timely manner going forward while adopting a multifaceted response that encompasses adjusting investment and development plans and consulting with its partners. |

| Risks of Fluctuations in Exchange Rates | The Group’s business operations are affected by fluctuations in exchange rates. Appreciation of the yen reduces the yen conversion amount in foreign currency denominated transactions. In addition, a portion of the Group’s assets and liabilities are converted into Japanese yen for the preparation of consolidated financial statements. Accordingly, even if there was no change in the value of said assets and liabilities in local currency terms, their value may be affected after yen conversion | The Group strives to minimize risks of fluctuations in exchange rates through such efforts as procuring funds in the relevant foreign currency when acquiring foreign currency-denominated assets. |

| Risks of Increases in Interest Rates | The Bank of Japan (BOJ) has implemented a policy of quantitative and qualitative monetary easing with yield curve control in response to the credit crunch in financial markets and the slowdown in the global economy. However, a rise in interest rates due to a change in the BOJ’s policy or a deterioration in the demand-supply balance for Japanese government bonds (JGBs) caused by growth in the issuance of JGBs may negatively affect the performance, financial position, or other aspects of the Group’s business. | The Group hedges interest rate risk on a portion of its variable interest rate financing through interest rate swaps to convert its interest rate payments into fixed payments. The Group plans to continue procuring funds in consideration of the balance between outstanding borrowings and corporate bonds with fixed and variable interest rates. |

| Information Security Risks, Such as Cyberattacks, Including Leaks of Personal Information | The Group’s performance could be affected in the unlikely event of external leaks of confidential information or the materialization of system risks due to unforeseen circumstances, such as information security incidents resulting from cyberattacks, computer viruses, or the like. | The Group has established regulations in relation to information management, based on which it implements a rigorous information management system, and complies appropriately with revisions to laws, such as the Act on the Protection of Personal Information. Moreover, in order to raise the IT security level Groupwide, the Group has positioned its DX Promotion Department at the center of efforts to standardize its IT systems and make them more secure. The Group is also enhancing collaboration among DX Promotion Department IT security personnel and between the department and external security companies, thereby providing Groupwide support. |

Emerging Risks for the Mitsubishi Estate Group's Business

Emerging Risks for the Mitsubishi Estate Group's Business

| Risks | Explanation of risks and business background | Impact on business | Action to mitigate risk |

|---|---|---|---|

| Soaring material costs and supply shortages due to the situation in Ukraine | The Mitsubishi Estate Group operates a real estate business that includes office buildings, condominiums, and commercial complexes. The main business model is to plan and design real estate projects within the Group, order construction from construction companies, and then lease properties to tenants. Construction companies procure construction materials that meet the Group’s design specifications, and this includes procurement of timber for use in construction. Timber is mainly used for concrete formwork panels and building interiors, and some of the timber procured is produced in Russia. In light of the situation in Ukraine, one of the risks is a shortage of timber due to unreliable imports of timber from Russia. The Group has also been using certified timber from Russia for some of the concrete formwork panels with the target of using 100% certified or domestically-produced timber. | Unreliable timber imports from Russia could lead to the following impacts on business [ Impact on costs and construction period ] Due in part to the impact of the wood supply shock, it is now very difficult to find alternative timber, and additional time and expense is involved in the search for alternatives. Furthermore, if the Group opts to use certified timber, as stipulated in the Group’s sustainability goals, the difficulty in obtaining timber will increase further. There could also be an impact on the construction period, and in that case, construction costs will increase. In addition, the cost of alternative timber itself is expected to increase. |

The Group established MEC Industry Co. Ltd. as a Group company that handles everything from procurement to sale of Japan-grown timber in an effort to promote its own procurement of timber and its incorporation into products. The Mitsubishi Estate Group considers Japan-grown timber to be low risk in terms of illegal logging and human rights and believes that it meets the Group’s standards. |

| Energy Crunch | The real estate leasing business is one of our major businesses, and we operate a variety of assets, including office buildings, rental condominiums, and commercial facilities. In the course of our leasing business, we use various types of energy, such as electricity and heat, which are major business costs. Energy costs are on an upward trend due to the recent sharp rise in fuel costs and other factors, and we view this as one of the emerging risks since the cost impact on our business is significant. | Rising energy prices will increase building operation and management costs and we view this as a cost risk as we operate and manage a large number of properties. | To reduce the impact of rising energy prices, for example, in the office leasing business, we are taking the following initiatives (1) Develop real estate with high energy performance. (For properties above a certain size, we make it mandatory to obtain green building certification, etc.) (2) Implement energy-saving measures to the extent that they do not interfere with the office operation business. |

| Human rights due diligence legislation | As human rights due diligence legislation is being implemented in Europe and elsewhere, the standards required are becoming more sophisticated. Since the Mitsubishi Estate Group does business in many countries, it believes it is necessary to comply with the legal systems in the countries where it operates. Even in countries where legal systems are not yet in place, it is also necessary to make preparations in advance of such legal systems. In addition, due to the nature of the real estate business, some of the Group’s business partners, for example the construction industry, are labor-intensive and thus high risk in terms of human rights. | The most significant impact of a delay in complying with legal systems related to human rights due diligence is expected to be a loss of trust from stakeholders. In particular, it could lead to a loss of trust from investors, which could lead to divestment, or a loss of trust from customers (tenants, condominium purchasers, etc.), which could, in turn, impact sales, etc. | In fiscal 2021, with the aim of further strengthening supply chain management, the Mitsubishi Estate Group revised its existing CSR Procurement Guidelines and established the Supplier Code of Conduct to set forth the matters it expects compliance from suppliers. The Group identifies high-risk suppliers in terms of human rights and the environment and conducts SAQ(self-assessment questionnaire) whether they comply with the contents of the Supplier Code of Conduct. Depending on the results of the SAQ, the Group requests improvements or conducts on-site audit. |

| Information security risk | The risk posed by cyberattacks is increasing year by year, and we consider it to be one of the management risks, with concerns including information leaks, unauthorized access to, and damage from ransomware attacks on information systems and data related to personal information, etc. of tenants of office buildings and commercial facilities and purchasers of condominiums. | The Mitsubishi Estate Group holds a vast amount of customer and business partner data, including personal information related to the tenants of office buildings and commercial facilities and the purchasers of condominiums, as well as information on orders placed with construction companies for new construction. The stable operation of information systems is also necessary for providing services outside of the Group and the execution of internal operations. Information leaks or threats such as ransomware attacks and unauthorized access lead to a decline in corporate credibility and hinder business activities, which could in turn impact business profitability. |

In light of society's growing concerns over appropriate information management, response to cyberattacks, and protection of personal information, the Mitsubishi Estate Group manages information by establishing rules related to information management (rules on information management, information systems, cybersecurity, and personal information) and updates its rules related to information management as required in response to changes in the environment and technology. The Group also strives to ensure strict information management through continuous monitoring and audits. Moreover, in order to raise the IT security level of the entire Group, we have established information management systems to implement measures such as the following:

|

| Business continuity risk due to natural disasters, etc. | Climate change-driven natural disasters, which include flooding due to abnormal weather and sudden heavy rain, typhoons, and hurricanes, have become more severe in recent years. It is thought this could impact on the business continuity of the offices and commercial facilities operated by the Company, and this has been identified as an emerging risk. | Abnormal weather, such as sudden heavy rain, thought to be due to climate change, could damage the offices and commercial facilities operated by the Company. If the Company is forced to suspend operations of its facilities due to this damage, the number of people using urban areas and facilities will decrease, and it will be harder to lease facilities to tenants, which could make it difficult to continue the business. In addition, if it is difficult to continue the business, it is also assumed there could be an impact on rental profits. |

The Mitsubishi Estate Group has installed advanced disaster prevention functions in the urban areas it develops and the buildings it operates as well as taking disaster response measures through area management. For example, in order to minimize the risk of flooding in office buildings it constructs, the Group takes all possible flood control measures including installling waterstopping equipment such as tide plates and watertight doors, and locating stockpile stores and key sites (e.g. power receiving and transforming equipment and disaster prevention centers) on above-ground floors. The Group has also been devising ways to develop highly disaster-resilient urban areas, such as installing systems in which electricity, water, and ventilation all function independently even when infrastructure supplies are cut in a disaster. The Mitsubishi Estate Group has established the Mitsubishi Estate Group Business Continuity Plan Guidelines, the Mitsubishi Estate Business Continuity Plan Documents, and the Mitsubishi Estate Group Guide to Preparing a Business Continuity Plan Document. By strengthening the bonds between the Business Continuity Plan and the Framework of Anti-Disaster Measures, we are ready to ensure both the safety of customers and Mitsubishi Estate Group employees as well as the business continuity of the Mitsubishi Estate Group in an emergency. Mitsubishi Estate Co., Ltd. has been implementing a variety of disaster prevention drill initiatives.

|

Scroll horizontally

Business Continuity Plan Initiative and Review

Business Continuity Plan Initiative and Review

The Mitsubishi Estate Group has drafted a Business Continuity Plan (BCP) to prevent crucial operations from being interrupted if a disaster or accident occurs — and, if they are suspended, to enable their speedy resumption — and we established "Mitsubishi Estate Group Business Continuity Plan Guidelines" in October 2006.

In December 2012, we established "Mitsubishi Estate Business Continuity Plan Documents" and the "Mitsubishi Estate Group Guide to Preparing a Business Continuity Plan Document" in light of the Great East Japan Earthquake. By strengthening the bonds between the Business Continuity Plan and the Framework of Anti-Disaster Measures, we are ready to ensure both the safety of customers and Mitsubishi Estate Group employees as well as the business continuity of the Mitsubishi Estate Group in an emergency.

Furthermore, in light of changes in the social and business environment, we strive to continually upgrade the content of the Business Continuity Plan through PDCA cycles and will implement further improvements going forward in order to fulfill our social responsibility.